The top wick, also known as the upper shadow, is the highest price. But when we talk about above the stomach evolves over a period of almost two sessions. To adequately understand candlestick patterns, you must have had a good understanding of Japanese candlesticks and all their attributes. Ideally, cradle https://currency-trading.org/strategies/nadex-strangle-strategy-examples-with-binary/ patterns should be an indication of reversal of the recent trend. The in-neck candlestick pattern is a 2-bar continuation pattern.Closing prices of both candles are the same or nearly the same forming a horizontal neckline. Statistics to prove if the In-neck pattern really works The in-neck…

It is identified by the last candle in the pattern opening below the previous day’s small real body. The small real body can be either black or white (red or green). The last candle closes deep into the real body of the candle two days prior. The pattern shows a stalling of the buyers and then the sellers taking control. It is formed of a long red body, followed by three small green bodies, and another red body – the green candles are all contained within the range of the bearish bodies. It shows traders that the bulls do not have enough strength to reverse the trend.

Momentum indicators in technical analysis – What are they? Uses

These patterns use the doji to mark a possible trend reversal. If the candles are moving down and then hit a doji and begin moving up, this would be an example of the morning doji star. The opposite https://day-trading.info/daily-treasury-yield-curve-rates/ pattern where the doji marks a trend reversal going down, then that would be an example of an evening doji star. A candle shows the opening, closing, high, and low price for a certain time period.

The bullish counterattack pattern is a bullish reversal pattern that predicts the upcoming reversal of the current downtrend in the market. This candlestick pattern is a two-bar pattern that appears during a downtrend in the market. A pattern needs to meet the following conditions to be a bullish counterattack pattern.

Down-Gap Side By Side White Lines Pattern

The lines above and below the body are referred to as wicks or tails, and they represent the day’s maximum high and low. The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. Today, Japanese candlestick charts are the most popular way to quickly analyse price action, particularly with technical traders.

Buddhist Supplies Market 2023 New Insights Market Research … – Digital Journal

Buddhist Supplies Market 2023 New Insights Market Research ….

Posted: Tue, 18 Jul 2023 07:18:20 GMT [source]

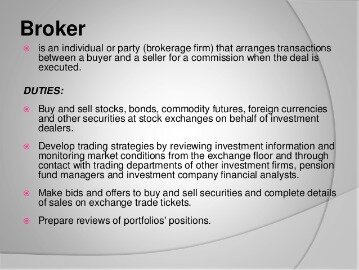

Also, as traders spot the reversal, they jump into trades in the new direction. Both these factors – prior traders getting out and new traders getting in – help propel the price in the new direction. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

Homing pigeons are considered less useful in highly volatile conditions. They tell you that bears were in almost total control of a session – and therefore that a downtrend could continue or an uptrend may reverse. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

Understanding Book Value per Share: A Comprehensive Guide for 2023-24

It has a big red candle, a gapped down doji and then a big green gapped up candle.The bearish abandoned baby follows an uptrend. An engulfing line is a strong indicator of a directional change. A bearish engulfing line is a reversal pattern after an uptrend. The key is that the second candle’s body “engulfs” the prior day’s body in the opposite direction. This suggests that, in the case of an uptrend, the buyers had a brief attempt higher but finished the day well below the close of the prior candle. This suggests that the uptrend is stalling and has begun to reverse lower.

- All of these patterns are characterized by the price moving one way, and then candles in the opposite direction appear that significantly thrust into the prior trend.

- After the appearance of the hammer, the prices start moving up.

- The Takuri candlestick pattern is a single candle bullish reversal pattern.

- The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

- Traders should make sure that if they have a moment of doubt, they can act on a situation if they have seen it before.

- There are many more candlesticks that have names attached to them but they are not as important.

The upper shadow shows the high price and lower shadow shows the low prices reached during the trading session. Sometimes powerful signals can also be given by just one candlestick. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open – like a star falling to the ground.

Evening star

The color of the body is insignificant to identifying the pattern. When spotted, the shooting star alerts crypto traders to the end of a bullish trend. Rather, it indicates that a reversal is likely to occur in the near future. The pattern is created by three trading sessions in a row with gaps in between. While each candle doesn’t necessarily have to be large, usually at least two or three of the candles are. The different parts of a candlestick pattern all tell you something.

The distinct shape and length of the three candles make them easy to spot on the charts and a favorite among traders looking for trend reversals. The concealing baby swallow candlestick pattern is a 4-bar bullish reversal pattern.The first candle must be a Marubozu which appears during a trend. The unique three river bottom candlestick pattern is a bullish reversal pattern.It occurs during a downtrend in the market. Statistics to prove if the Unique Three River pattern really works What is the unique three river… The matching low candlestick pattern is a 2-bar bullish reversal pattern. It occurs during a downtrend.As his name suggests, both lows from the 2 candles are equal.

A Deep Dive Into The Burgeoning Field of Media Buying

So, late buying or selling candles with one or more candlesticks run out of liquidity before heading in the intended direction are called institutional candles. It means institutions sell before buying and buy before selling. That’s why the institutional candle is also called ‘Bankers Candle.’ It is one of the most popular smart money forex trading concept. The kicker pattern is one of the strongest and most reliable candlestick patterns. It is characterized by a very sharp reversal in price during the span of two candlesticks. In this example, the price is moving lower, and then the trend is reversed by a gap and large candle in the opposite direction.

The kicking candlestick pattern is a 2-bar reversal pattern.It is made of two opposite side marubozus separated by a price gap. Statistics to prove if the Kicking pattern really works The kicking candlestick pattern is a two-bar… The counterattack candlestick pattern is a reversal pattern that indicates the upcoming reversal of the current trend in the market.

And there are novelty types—sparklers and trick candles that refuse to blow out—for festive occasions. You can even choose among flameless candles that provide light through tiny lightbulbs and batteries for occasions when you want to avoid the hazards of open flames. A candle uses a wick embedded in wax or another slightly flammable solid material to produce light as it gradually burns. For today’s users, candles are the perfect way to create an ambiance, set a certain mood, and introduce a cozy feeling into your home.

Tesla Set to Break $300? – LiveTradingNews

Tesla Set to Break $300?.

Posted: Thu, 13 Jul 2023 06:36:33 GMT [source]

They offer much more information visually than traditional line charts, showing a market’s highest point, lowest point, opening price and closing price at a glance. All currency traders should be knowledgeable of forex candlesticks and what they indicate. After learning how to analyze forex candlesticks, traders often find they can identify many different types of price action far more efficiently, https://topforexnews.org/brokers/liteforex-review-and-rating-liteforex-com/ compared to using other charts. The added advantage of forex candlestick analysis is that the same method applies to candlestick charts for all financial markets. The tables below summarize the two main categories of price movement that candlesticks can indicate. A candlestick with a long upper wick and short lower wick shows that buyers were very active during a trading period.